Biofuels for transport in the EU: production and consumption

For the SAF platform, our expert Semen Drahniev has prepared a detailed and comprehensive overview on the production and consumption of biofuels for transport in the EU. The review is based on the “European Union: Biofuels Annual“ report by the U.S. Department of Agriculture (USDA).

Report Highlights:

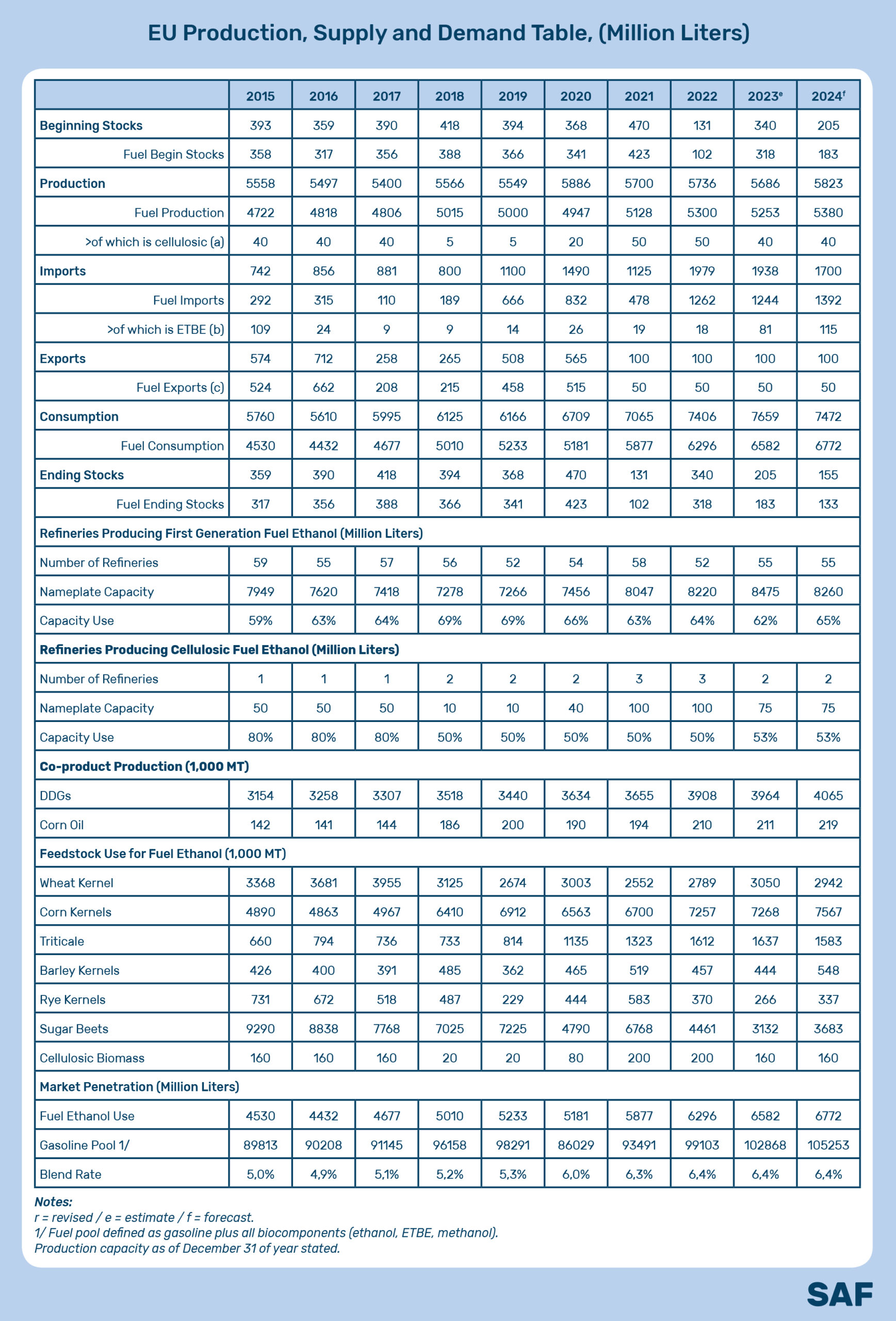

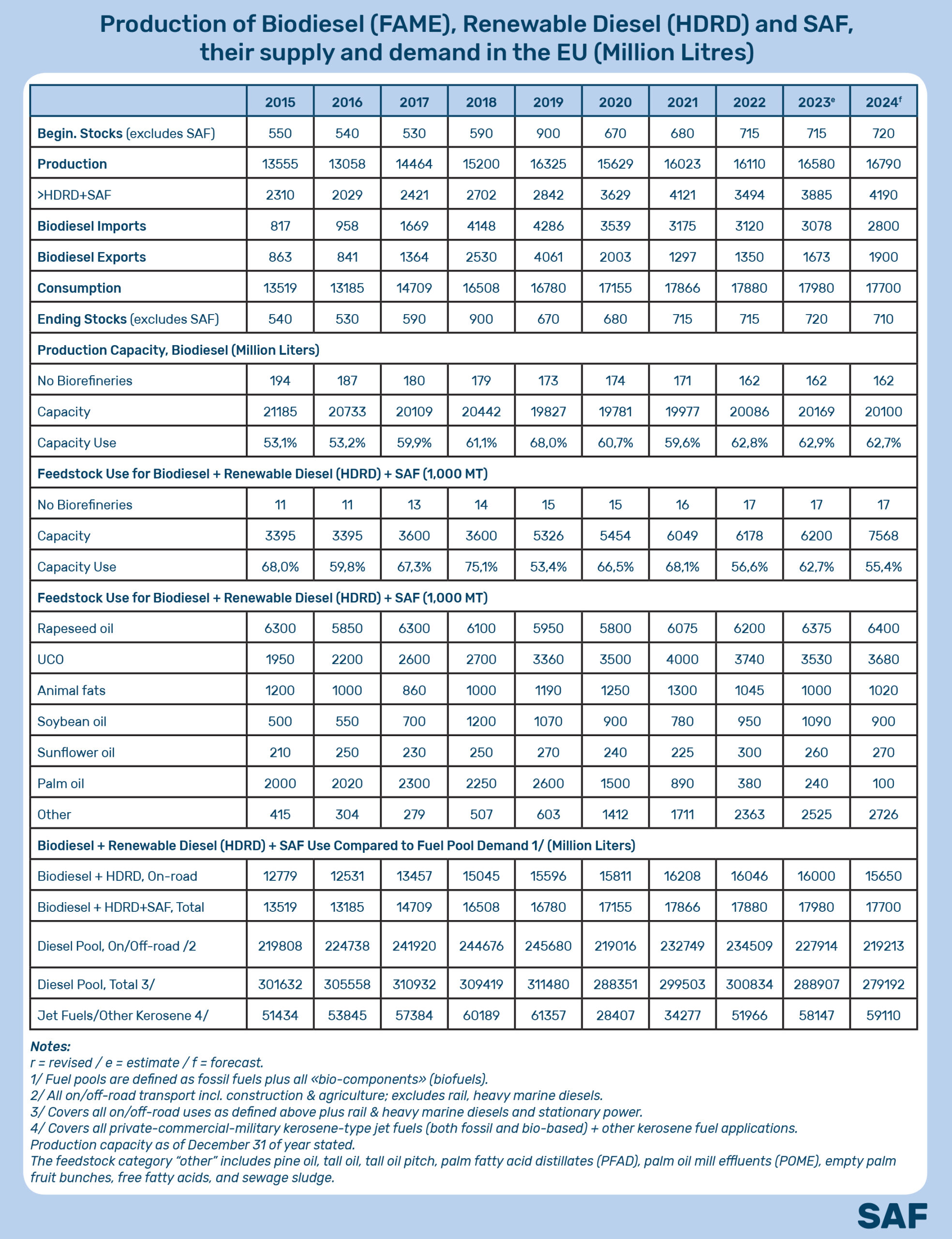

- In 2023, consumption of bioethanol and biomass-based diesel (BBD) are estimated to have increased by respectively 4.5 percent to 6.58 billion liters and 0.6 percent to 17.98 billion liters.

- For bioethanol, the expansion is mainly due to gasoline fuel pool growth, while growth for BBD is entirely due to increased blending.

- Whereas bioethanol use is forecast to further grow in 2024, BBD use is anticipated to fall based on reduced national greenhouse gas (GHG) reduction mandates and the use of BBD types with higher GHG reduction values.

- About a third of the domestically produced BBD is produced with waste oils and fats.

- Sustained growth in demand is forecast to support EU bioethanol imports this year. BBD imports are forecast to be restricted by new traceability and reporting rules.

EU policy on biofuels for transport

The European Commission (EC) has adopted a number of legislative proposals that will affect the use of biofuels in the road, air and maritime transport sectors in the medium and long term.

The EU Renewable Energy Directive (RED II) has been revised to align with the EU’s Green Deal goals of:

- a reduction of greenhouse gas (GHG) emissions of 55 percent by 2030.

- carbon neutrality by 2050.

- an overall renewableenergy target of at least 42.5 percent by 2030.

This revised REDII entered into force on November 20, 2023, with an 18-month period to transpose most of the Directive’s provisions into national law.

For transport, Member States can choose between:

- a target of reducing greenhouse gas (GHG) intensity by 14.5 percent up to 2030 (compared to 1990);

- ensuring a share of at least 29 percent of renewables in final energy consumption by 2030.

Bioethanol

Bioethanol is produced by fermenting the carbohydrate components of plant materials. In the EU, the most used feedstocks are grains (e.g., corn, other coarse grains, and wheat kernels) and sugar beet. ‘Synthetic’ ethanol made from petroleum fuels is restricted to a very small market and is not included in this report. Ethanol used as transport fuel is referred to as bioethanol in this report.

The overall EU increase in bioethanol use of 4.5 percent in 2023 and 2.9 percent in 2024, based on:

- the further market introductions or continued expansion of E10 in many countries;

- rising availability of E85 in France;

- an overall increase in the gasoline fuel pool across the EU.

Increased sales of the higher blends in France are the main driver for total EU bioethanol consumption

Biobased Diesel

Bio-based diesel (BBD) includes biodiesel (fatty acid methyl esters, aka FAME) and renewable diesel. Renewable diesel, a full drop-in fuel replacement for fossil diesel, can be produced thru various feedstock-technology platform pathways.

The EU is the world’s largest BBD market for both production and consumption.

BBD consumption is driven almost exclusively by Member State blending and GHG reduction mandates and, to a lesser extent, by tax incentives. In 2020, a six percent GHG reduction mandate became applicable for all fuel suppliers in the EU (see Policy and Programs chapter). This favors the use of FAME with high GHG reduction values and HDRD, and especially the latter in countries already close to the seven percent volumetric blending limit for FAME (stipulated in the FQD).

BBD production is forecast to increase by 1.3 percent to 16.8 billion liters in 2024, largely driven by strong demand from export markets such as the United States and United Kingdom. However, this masks different developments for FAME and HDRD. HDRD production is expected to grow by 7.9 percent powered by increases in Sweden and Italy, as capacity increases in both countries. In contrast, EU-wide FAME production is forecast to marginally decline by 0.8 percent.

Read the full article with information about advanced biofuels on the SAF platform.

We remind you that UABIO is a partner of the Sustainable agribusiness platform (SAF).

SAF is a communication platform that brings together agribusiness stakeholders and aims to establish strong links between market players and introduce sustainable approaches in agriculture. For this platform, our team prepares verified professional content on the bioenergy sector.